Remote Patient Monitoring (RPM) has moved from being a “future idea” to becoming a core part of U.S. healthcare delivery. In 2025, the momentum is stronger than ever. Medicare has kept RPM coverage stable, providers are enrolling more patients, and technology is advancing to make remote care easier, smarter, and more reliable.

This year, stability in Medicare rules has given providers the confidence to expand their programs, while proposed updates for 2026 are already shaping conversations inside medical groups. Technology, too, is evolving — cellular devices are replacing app-only models, and artificial intelligence is being built into platforms to reduce the burden on staff.

As an RPM-focused platform, CandiHealth works closely with clinics and doctors across the U.S. We see where adoption is growing, what challenges providers face, and which approaches bring real results. This guide brings those insights together by highlighting the nine biggest RPM trends in the USA in 2025 and what they mean for your practice.

Let’s get started.

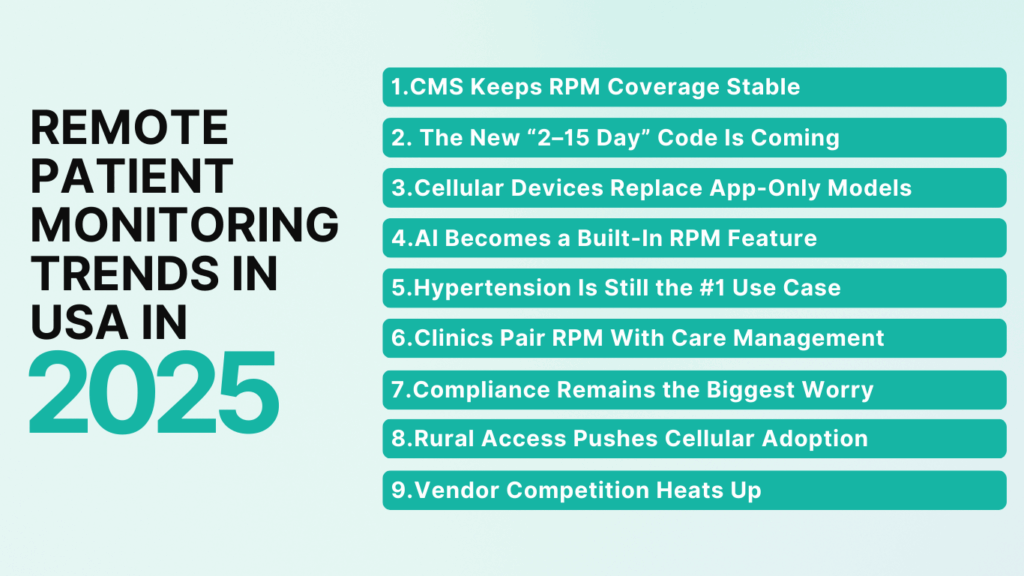

Remote Patient Monitoring Trends in USA in 2025

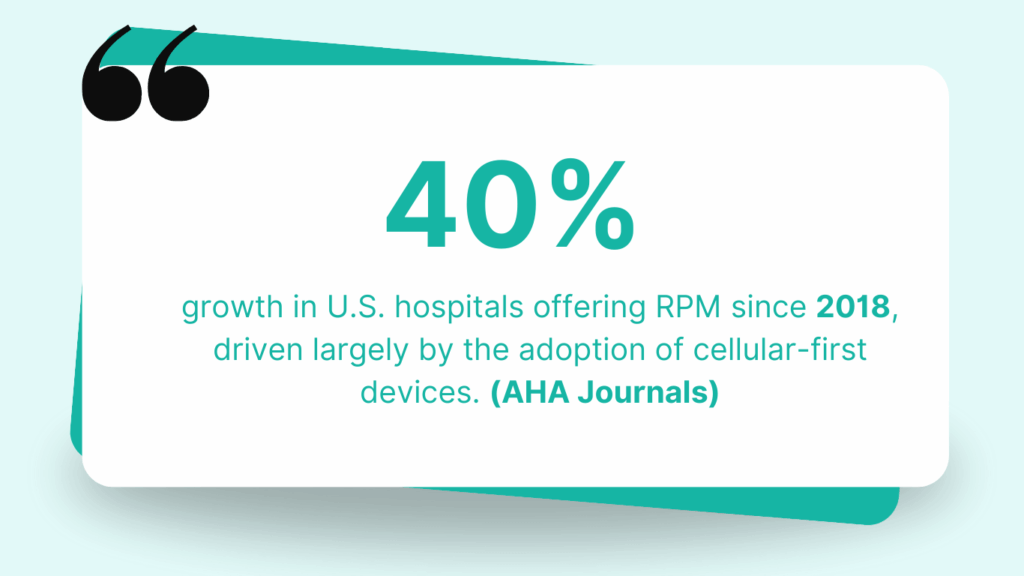

RPM is scaling fast. For example, CPT 99454 was billed 1.64 million times in 2023, a nearly 29% increase over the prior year. Hospitals also scaled adoption. Over 5 years, the number of U.S. hospitals offering RPM rose by 40.3 %. Projections show that by 2025, ~26% of Americans (≈ 71 million people) may use some form of RPM.

Here are the nine main RPM trends we see shaping 2025:

- CMS Keeps RPM Coverage Stable

- The New “2–15 Day” Code Is Coming

- Cellular Devices Replace App-Only Models

- AI Becomes a Built-In RPM Feature

- Hypertension Is Still the #1 Use Case

- Clinics Pair RPM With Care Management

- Compliance Remains the Biggest Worry

- Rural Access Pushes Cellular Adoption

- Vendor Competition Heats Up

Here is a detailed breakdown of each trend.

1. CMS Keeps RPM Coverage Stable in 2025

Policy stability is often overlooked as a trend. But in healthcare, consistency drives adoption. The more predictable RPM rules become, the faster practices are willing to commit staff time, buy devices, and build long-term patient programs.

The biggest signal in 2025 is that nothing has been taken away. CMS kept all five core RPM codes (99453–99458) intact in the 2025 Physician Fee Schedule.

The data proves why this matters. CPT 99454, the monthly device supply and transmission code, was billed 1.64 million times in 2023, up 29% from 2022. The core requirements remain the same:

- Patients must already have an established relationship with the provider.

- Consent (verbal or written) must be documented.

- Devices must be FDA-defined medical devices that automatically transmit data.

What this means for clinics: Healthcare providers can build workflows, train staff, and grow patient enrollment without worrying that Medicare will reverse course. Stability lowers risk and allows practices to shift their focus from compliance basics to outcomes and scale.

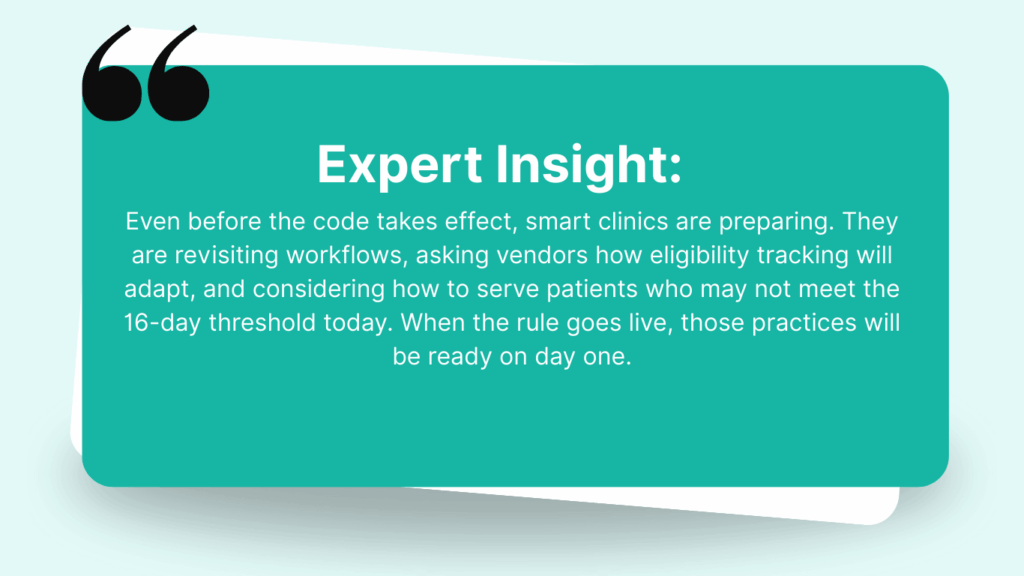

2. The New “2–15 Day” Code Is Coming

Few rules in RPM have caused more frustration than the 16-day requirement. A patient who checks blood pressure 14 times in a month doesn’t qualify for reimbursement. That gap has left thousands of patients outside the system, and providers know it.

In July 2025, CMS proposed a new code, referred to as 99XX4, that would cover 2–15 days of monitoring in a month. If finalized for 2026, this code would be paid at the same rate as 99454. (CMS CY 2026 PFS Proposed Rule)

Why does this matter in 2025 if it’s not active yet? Because practices are already planning for it. And this proposal is one of the most discussed RPM topics in 2025. It tells providers that CMS is listening to real-world challenges and wants to expand access, not restrict it.

3. Cellular Devices Replace App-Only Models

App-based RPM devices once looked promising, but in practice they created barriers. Patients struggled with Wi-Fi, app logins, and technical errors. Many devices ended up unused, leaving providers without the consistent data they needed.

In 2025, clinics are turning to cellular-enabled monitors. These devices send readings directly to the provider’s dashboard with no apps or Wi-Fi required. For seniors and rural patients, this shift removes the biggest barrier to participation.

U.S. hospitals offering RPM grew by more than 40% since 2018, with cellular-first devices leading much of that adoption. (AHA Journals)

At CandiHealth, we’ve seen clinics improve adherence and reduce technical support calls by standardizing on cellular-first kits.

4. AI Becomes a Built-In RPM Feature

Two years ago, AI in remote monitoring was “nice to have.” In 2025, it’s becoming standard. Clinics no longer want raw data streams; they want platforms that can filter noise, highlight urgent cases, and free up staff time.

The shift is driven by workload pressure. Many practices manage hundreds of patients on RPM, and reviewing every reading manually is no longer realistic. AI triage helps by surfacing patterns and exceptions without drowning staff in alerts.

“In 2025, AI in RPM isn’t about replacing clinicians — it’s about giving them signals instead of noise.”

For providers, this changes how platforms are evaluated. If AI-driven triage isn’t built in, the system feels outdated.

5. Hypertension Is Still the No.1 Use Case

Hypertension continues to dominate remote patient monitoring in 2025. It’s the most common chronic condition managed through RPM. Blood pressure is simple to measure, easy for patients to track, and directly tied to outcomes that matter for both quality metrics and reimbursement.

Other conditions like heart failure, kidney disease, and diabetes are gaining ground, but hypertension remains the entry point. Clinics often start their RPM programs with high-risk hypertensive patients before expanding into broader chronic disease management.

At CandiHealth, we see providers enrolling hypertensive patients first because they represent both the greatest clinical need and the clearest path to meeting CMS requirements. As adoption widens, these programs naturally expand to other chronic conditions, but blood pressure monitoring will remain the foundation of RPM.

Read more about hypertension management in this blog: How Remote Patient Monitoring Helps Manage Hypertension Effectively

6. Clinics Pair RPM with Care Management

RPM has proven its value, but in 2025 the leading clinics aren’t running it in isolation. They are pairing it with Chronic Care Management (CCM) to strengthen outcomes and create steadier revenue streams. This combination is becoming a defining trend of the year. The logic is simple:

- RPM delivers real-time data.

- CCM provides structured monthly follow-up.

Together, they close the gap between daily monitoring and ongoing care planning. A 2024 study found that practices using both RPM and CCM achieved 20–25% higher patient engagement rates compared to those using RPM alone.

7. Compliance Remains the Biggest Worry

In 2025, compliance remains the biggest source of anxiety for providers. A single missing consent note, a patient who logs only 15 days instead of 16, or an incomplete time record can turn into denied claims or repayment demands. These setbacks threaten the financial sustainability of small practices RPM programs.

The problem isn’t that the rules are unclear. CMS has spelled out the requirements: an established patient relationship, documented consent, FDA-approved devices that transmit data automatically, and strict thresholds for billing. The real challenge is execution. Busy staff can’t be expected to track every detail manually while also delivering care.

The solution is to focus on compliance as a system, not a side task. Leading clinics build workflows where requirements are checked automatically. Consent is captured once and stored and day counts are tracked in the background.

8. Rural Access Pushes Cellular Adoption

Many rural areas in the U.S face limited broadband coverage, and older patients are less likely to adopt technology. When RPM depends on Wi-Fi or app setup, these patients are effectively excluded.

That’s why 2025 is seeing stronger adoption of cellular-enabled RPM devices in rural health clinics and federally qualified health centers (FQHCs). With cellular cuffs, patients simply take a reading and the data transmits automatically. No Wi-Fi, no apps, no setup. This single change makes RPM accessible to groups that were previously out of reach.

At CandiHealth, we’ve seen rural programs thrive when cellular kits are standard. Clinics report fewer onboarding issues, higher adherence, and better patient satisfaction because the technology works seamlessly in low-connectivity environments.

9. Vendor Competition Heats Up

The RPM market in 2025 is more crowded than ever. Established players are expanding their offerings, while new startups are entering with low-cost devices and promises of quick setup. For clinics, this creates both opportunity and risk.

The opportunity is a choice. Providers can now evaluate platforms based not only on price but also on features like automated compliance, AI-driven triage, and integration with care management. The risk is many vendors sound the same, and some cut corners on device quality or support.

📊 Analysts estimate the U.S. RPM market will exceed $5 billion in 2025, with a projected CAGR of around 10% through 2030. (iData Research) Growth attracts competition, but not all solutions are built for long-term sustainability.

Conclusion: Positioning for RPM Success in 2025

The nine trends shaping RPM in 2025 point to the same conclusion: remote monitoring is a standard part of care delivery. Stable Medicare rules, proposed new rules, cellular-first devices, AI-driven triage, and the integration of RPM with care management are all signals of a market that is maturing quickly.

For clinics, the challenge is deciding how to keep up without overloading staff or exposing the organization to compliance risks. The practices that win will be those that treat RPM not just as a billing opportunity but as a sustainable care model — one built on patient adherence, audit-ready documentation, and smart use of technology.

At CandiHealth, our focus is to help providers achieve exactly that. From cellular-enabled devices to automated alerts, we’ve built our platform to align with the trends that matter most in 2025. The goal isn’t more technology for its own sake — it’s reliable systems that make care better for patients and sustainable for providers.