Remote Patient Monitoring (RPM) has gone from a niche service to a fast-growing healthcare tool — with Medicare spending on RPM surging from just $6.8 million in 2019 to $194 million in 2023. That growth brings huge opportunities for providers and increased scrutiny from payers.

Billing RPM services is about staying compliant, avoiding costly claim denials, and protecting your practice from audits. Small errors in coding or documentation can add up to big losses, both financially and reputationally.

In this guide, we’ll walk you through the 2025 RPM billing guidelines you need to know. You’ll get a clear overview of the key CPT codes, Medicare rules, and best practices for compliance, plus workflow tips to make billing smoother and more accurate.

Table of Contents

What is RPM Billing?

RPM billing guidelines (2025) are Medicare and payer rules that define how providers document, code, and bill for Remote Patient Monitoring services, ensuring compliance, reimbursement, and audit readiness. These guidelines outline exactly what counts as billable RPM, which codes to use, and the requirements for documentation and device usage.

You might be wondering what RPM billing means in healthcare? In practice, RPM billing means claiming reimbursement for tracking a patient’s health data outside of traditional appointments.

This can include vital signs such as blood pressure, oxygen levels, or glucose readings, all gathered through connected devices and transmitted securely to the provider. It covers both the technology side (devices and data transmission) and the clinical side (reviewing and responding to patient data).

How is RPM billing different from RTM billing?

While the two sound similar, they serve different purposes. RPM involves monitoring physiological data from medical devices, while Remote Therapeutic Monitoring (RTM) is for non-physiological data, such as therapy adherence or self-reported symptoms. Medicare rules clearly state that you can’t bill RPM and RTM for the same patient in the same month.

Why is RPM reimbursable under Medicare and private payers?

Because it enables continuous care, identifies health issues earlier, and reduces costly hospital visits. Medicare, and many commercial insurers following its lead, see RPM as a proven way to improve outcomes and lower overall healthcare costs.

Want a complete breakdown of the CPT codes used for RPM billing? See our complete RPM CPT codes guide.

Overview of RPM CPT Codes

When it comes to RPM billing, Current Procedural Terminology (CPT) codes (99435, 99454, 99457 and 99458) are what translate your remote monitoring work into billable claims. These codes define exactly services provided, billing frequency, and required documents.

Here is a quick table to RPM CPT codes:

| CPT Code | Service Description | Billing Frequency | Key Requirement |

| 99453 | Initial setup & patient education | Once per patient/device per 30 days | Document training & consent |

| 99454 | Device supply & data transmission | Monthly | ≥16 days of data in a 30-day period |

| 99457 | First 20 mins of care management | Monthly | Interactive communication |

| 99458 | Additional 20 mins of care management | Monthly | Add-on to 99457 |

For a deep dive into each CPT code, including reimbursement rates, documentation tips, and common billing mistakes, check out our Complete RPM CPT Codes Guide.

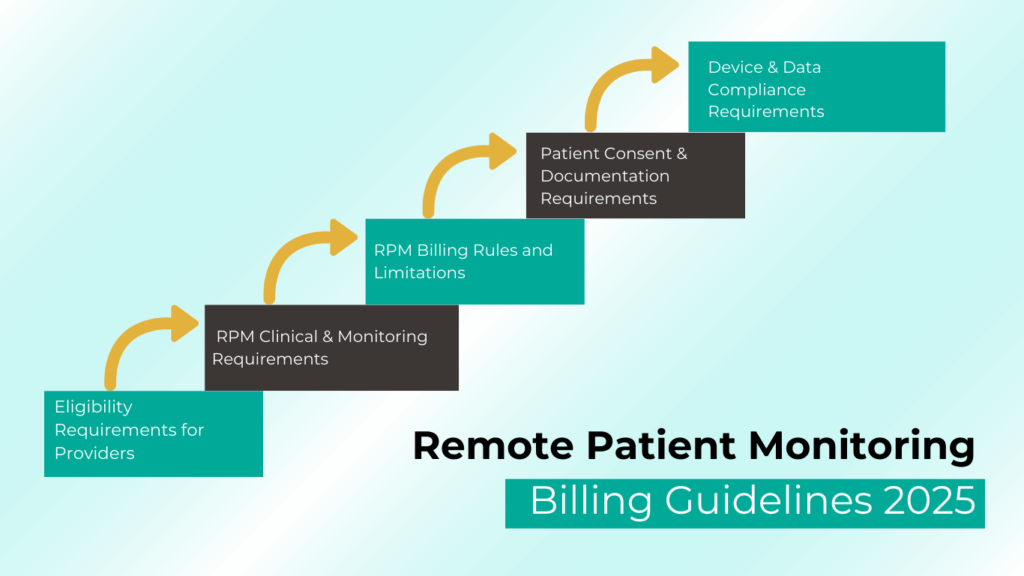

RPM Billing Guidelines for 2025

Getting paid for Remote Patient Monitoring (RPM) under Medicare means following specific billing rules. These requirements ensure services are both clinically appropriate and well-documented, reducing the risk of denials or audits.

Medicare RPM Billing Checklist (2025)

- Have an established patient relationship before starting RPM.

- Only eligible providers (physicians/qualified NPPs) can bill RPM.

- Monitor an acute or chronic condition and meet the 16-day device data rule for CPT 99454.

- Bill only one provider per patient per month.

- RPM and RTM cannot be billed together in the same month

- Obtain documented patient consent (verbal or written).

- Use FDA-approved devices with secure, automatic data transmission.

- Auxiliary staff may deliver RPM under general supervision.

Here is the detailed overview of each Medicare rule.

1. Eligibility Requirements for Providers

- RPM requires an established patient relationship. It can’t be billed for a new patient without prior engagement.

- Only physicians and non-physician practitioners eligible to provide evaluation and management (E/M) services can bill RPM.

- Practitioners not in the global period for surgery services can bill for RPM.

2. RPM Clinical & Monitoring Requirements

- You must be monitoring an acute or chronic condition.

- For CPT 99454, at least 16 days of device-generated data must be collected within a 30-day period.

- Monitoring must be medically reasonable and necessary, supported by proper clinical documentation.

3. RPM Billing Rules and Limitations

- Only one practitioner can bill RPM for a patient during a 30-day period.

- RPM and RTM cannot be billed for the same patient in the same month.

- You may bill RPM or RTM alongside other care management services (e.g., chronic care, behavioral health integration), but time and effort cannot be counted twice.

4. Patient Consent & Documentation Requirements

- Medicare requires documented patient consent (verbal or written) before starting RPM services.

- Maintain records that clearly support medical necessity, time spent, and device usage for every billing period.

5. Device & Data Compliance Requirements

- The device must meet the FDA definition of a medical device.

- Data must be electronically collected and automatically transmitted to a secure location for analysis by the billing practitioner.

- Auxiliary personnel can deliver RPM services under the general supervision of the billing practitioner.

How to Stay Compliant with RPM Billing Guidelines?

To meet Medicare RPM billing compliance standards, you must:

- Obtain documented patient consent (verbal or written).

- Prove device usage meets the 16-day data requirement for codes like 99454.

- Track clinical time accurately for 99457 and 99458.

- Use FDA-approved devices that automatically transmit data.

What are the Common RPM Billing Mistakes and How to Avoid Them?

Search data shows many providers want to know “what causes an RPM billing audit?”

Here are the most common triggers:

- Billing RPM and RTM together for the same patient in the same month.

- Missing proof of device setup or patient education.

- Inflating care management minutes beyond what was delivered.

- Lack of evidence for medical necessity.

Prevent these by implementing pre-claim review checklists and using automated time-tracking tools like CandiHealth software in your RPM platform.

What are the Best Practices for RPM Documentation in 2025

For providers searching “RPM documentation requirements”, here’s what you need:

- Use EHR templates built for RPM CPT codes.

- Log all patient interactions — calls, messages, and data reviews.

- Store device transmission reports securely for audit readiness.

- Keep records for at least 7 years in compliance with Medicare and payer requirements.

Looking Ahead: Medicare’s 2026 Proposed Changes for RPM Billing

On July 14, 2025, the Centers for Medicare & Medicaid Services (CMS) released its proposed rule for the 2026 Medicare Physician Fee Schedule (PFS), which includes important updates to Remote Patient Monitoring (RPM) billing.

While still in the proposal stage, these changes aim to:

- Introduce new CPT codes for shorter monitoring periods (e.g., 2–15 days) and shorter treatment management times (10–20 minutes).

- Adjust existing codes like 99454 to clarify data requirements for 16–30 day monitoring periods.

- Emphasize reimbursement accuracy based on service duration and patient needs.

If finalized, these updates could expand flexibility in RPM services, improve care coordination, and help providers bill more precisely for varying levels of patient monitoring.

For a full breakdown of the proposed codes, reimbursement changes, and what they could mean for your practice, read our Medicare’s 2026 Proposed Changes for RPM Billing Codes.

Final Thoughts

Accurate RPM billing in 2025 is about protecting your practice from compliance risks, reducing claim denials, and making sure your patients continue receiving uninterrupted care. By following Medicare’s RPM billing guidelines, using the right CPT codes, and keeping documentation airtight, you can maximize reimbursements while staying audit-ready.

CandiHealth’s Remote Patient Monitoring platform is designed to make you compliant ready.

- Automatic time tracking for CPT 99457/99458.

- Device usage reporting to meet the 16-day rule.

- Built-in consent logging and documentation templates.

- Real-time compliance alerts before claims are submitted.

Whether you’re just starting RPM or optimizing an existing program, CandiHealth helps you bill confidently, stay compliant, and focus on patient care.

Book a free demo today and see how easy RPM billing can be with CandiHealth.

Frequently Asked Questions (FAQs)

1. Which CPT codes are used for RPM billing?

The main Medicare-recognized RPM codes are 99453, 99454, 99457, 99458, and 99091. Each serves a distinct purpose—covering everything from patient onboarding to device supply and ongoing management.

2. What does each CPT code cover?

99453: One-time reimbursement for initial patient setup and device education.

99454: Monthly reimbursement for device supply and automated data transmission.

99457: Covers the first 20 minutes per month of clinical staff, physician, or other qualified provider time spent on RPM management with interactive communication.

99458: Each additional 20 minutes beyond the initial 99457.

3. How many days of data are required to bill 99454?

For 99454, CMS requires at least 16 days of device-generated readings within a 30-day period. This rule ensures that RPM services are being used consistently.

4. Can RPM codes be billed every month?

Yes, but billing is based on rolling 30-day cycles, not the standard calendar month. For example, if a 30-day period starts mid-month, the next billing cycle starts on the 31st day after service initiation.

5. What counts as “interactive communication” for 99457?

It must be real-time, two-way communication between patient and provider—phone or video calls qualify. Email, text messages, or voicemails alone do not count toward the interactive requirement.

6. Can RPM and RTM be billed together?

No. Medicare prohibits billing RPM (99453–99458) and RTM (98975–98978) for the same patient during the same service period. Providers must choose the most appropriate code set.

7. Can RPM be billed with CCM or TCM?

Yes, RPM can be billed alongside Chronic Care Management (CCM), Transitional Care Management (TCM), Behavioral Health Integration (BHI), or Principal Care Management (PCM) as long as the time and services are not double-counted.